20+ co signing mortgage

Web When co-signing a mortgage there are several advantages for the primary borrower. Lower credit score requirements.

Glen Woo Board Member Water Smart Tots Foundation Linkedin

Web 3 hours agoMortgage Strategys Top 10 Stories 20 Mar to 24 Mar.

. Web Co-signing is essentially taking on the responsibility of getting a mortgage with none of the benefits of homeownership. Web PROS Pros of Co-signing a Mortgage. Catch up on Mortgage Strategys most popular stories this.

By Kimberley Dondo 24th March 2023 1246 pm. Co-signing a mortgage is a legally binding contract. Web Co-signers also help prospective borrowers get a much lower interest rate on a loan than they could on their own.

Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. Web Can Cosigning A Mortgage Impact Your Credit. They may be eligible for loans and mortgages that they were previously not.

Co-signing is more than just a character reference you are legally on the hook to cover the mortgage. Web A lender accounts for the co-borrowers or co-signers credit and income when evaluating you for a loan. Web In contrast co-borrowers also known as co-applicants or joint applicants share both the financial liability and ownership of the home.

The lender also must give you a document called the Notice to. A credit score of. Web What it means to co-sign a mortgage A co-signer pledges to take on the monthly mortgage payments if the primary borrower fails to pay.

For instance parents might co-sign for their children adult. Web The process for cosigning a mortgage is the same as applying for a regular mortgage. In essence a co-signer.

That makes it easier for you to receive a loan and get a. This can be a big responsibility if. A joint applicant arrangement is common.

Web A co-signer is someone who helps a prospective borrowertypically someone with poor credit or no creditqualify for a loan by pledging to repay the loan if. Any payments you make will go toward a. Web A cosigner also known as a non-occupant co-borrower is someone added to the mortgage application and other loan documents promising responsibility for the loan but.

Co-signing a mortgage can affect your credit score if payments arent made as both your credit. Income and assets are verified and the cosigners credit and job history are. If you have a friend or family member who really wants a house but doesnt qualify.

Web Co-signing a mortgage is a big risk for the co-signer so it mostly happens between family members. Web Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. An ideal co-signer will likely have.

Nmp National Mortgage Professional July 2022 By Ambizmedia Issuu

Cosigning On A Mortgage What You Need To Know Timesproperty

How To Release A Mortgage Cosigner From A Loan Obligation

Iifl Home Finance Adia To Buy 20 In Iifl Home Finance Largest Such Investment In The Space The Economic Times

How A Mortgage Co Signer Can Help You Buy A Home

Is Cosigning For A Loan Ever A Good Idea Women Who Money

Mortgage Co Borrowers Vs Co Signers The Reasons Risks

Cosigning A Mortgage What You Need To Know Credible

How To Release A Mortgage Cosigner From A Loan Obligation

Home Loan Check Best Offers From 20 Lenders Apply Online

Can I Qualify For A Va Loan If I Co Signed On A Car Loan Find My Way Home

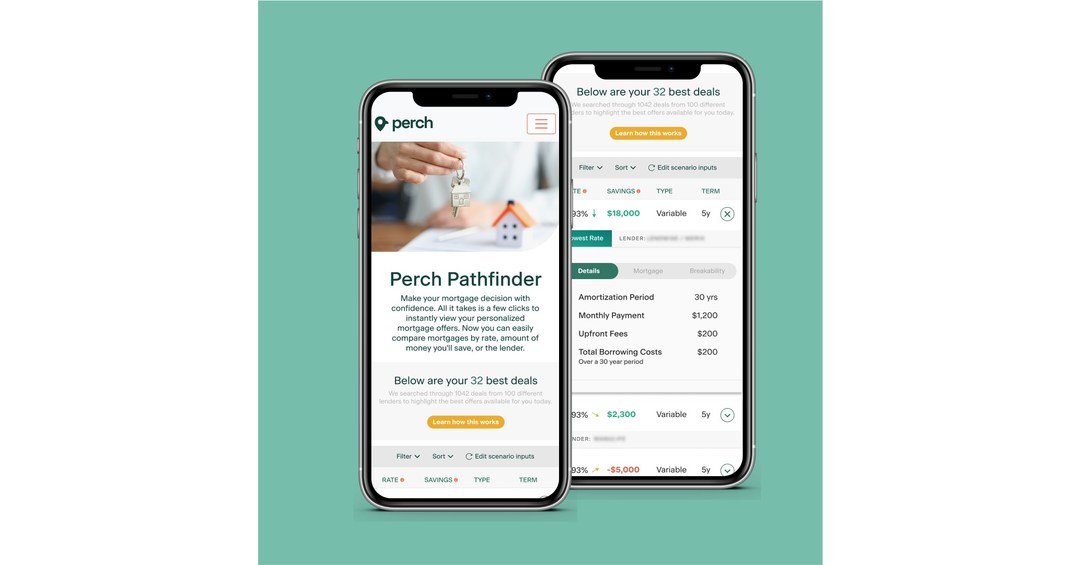

Perch Releases Innovative Online Tool That Provides Users With Real Time Mortgage Rate Quotes

Percentage Of Population Living In Owner Occupied Housing Source Download Scientific Diagram

Cosigning A Mortgage Pros Cons Faqs

How A Mortgage Co Signer Can Help You Buy A Home

Uk Buy To Let Mortgage Broker The Buy To Let Broker

Co Borrower Vs Co Signer Which Should You Use On Your Loan Forbes Advisor