33+ Estimate monthly mortgage payment

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Full Monthly Payment capital interest.

33 Contract Templates Word Docs Pages Free Premium Templates

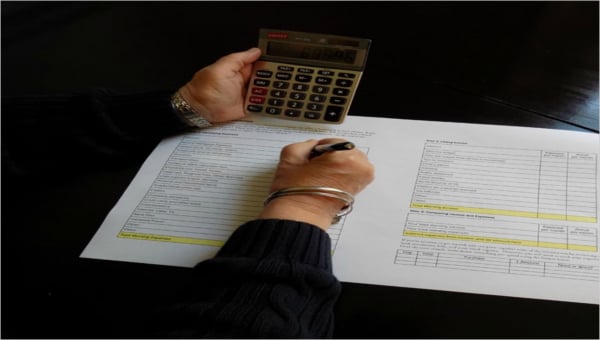

We take your inputs for home price mortgage rate loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest.

. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs. Monthly Yearly Mortgage Payments per Thousand Financed. You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587.

Lean how the two key parts of your monthly mortgage payment principal and interest work. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15-year might cost 73969 a month. In some cases your lender might not offer a bi-weekly payment schedule.

You can still produce a similar effect by adding a specific amount to your monthly mortgage payments. Enter some basic information to get started. Good faith estimate or GFE means an estimate of settlement charges a borrower is likely to incur as a dollar amount and related loan information based upon common practice and experience in the locality.

Youll need a few numbers to calculate a monthly mortgage payment including the mortgage principal interest rate and loan term. Its important to consider the overall mortgage costs not just the monthly payment. Interest rate is 4 the monthly interest rate would be 033.

Tools and calculators are provided as a courtesy to help you estimate your. This is the rate the borrowers monthly payment is based on. 1500 100 400 2000 If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000.

Note that your monthly mortgage payments will vary depending on your interest rate taxes PMI costs and other related fees. Scan down the interest rate column to a given interest rate such as 7. Deposit 5 37500.

For example 15-year loans come with lower interest rates than 30-year loans. You can purchase a house worth 305193. 2 the tax bill was mailed or delivered by electronic means to the mortgagee of the property but the mortgagee failed to mail a copy of the bill to the.

Assuming you have a 20 down payment 16000 your total mortgage on a 80000 home would be 64000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 287 monthly payment. What Are Current Mortgage Rates. Principal Interest payment.

This calculator determines how much your monthly payment will be for your mortgage. They can be fixed or adjustable and the rates themselves will vary based on how the duration of the loan is structured. The following amount is the extra payment that must be applied to your principal each month.

Then follow across to the payment factor for either a 15 or 30 year term. Our mortgage calculator can help you estimate your monthly mortgage payment. Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage.

Quickly Estimate Calculate Your Borrowing Costs Your Results in Plain English Switch to Financial. For your convenience we publish current Boydton mortgage rates to help you estimate the price of various loan options. Mortgage rates play an outsized role in determining what your estimate mortgage payment monthly will be.

Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. Heres how much your monthly mortgage payment will cost.

The chart below shows your monthly principal and interest PI payment on a 30-year fixed interest rate mortgage based on a range of FICO scores for three common loan amounts. 15 YR Monthly Payment 15 YR Total 15 YR Interest 30 YR Monthly Payment 30 YR Total 30 YR Interest. Selling Price Down Payment Interest Rate Years.

With each subsequent payment you pay more toward your balance. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. National Average Mortgage Rates.

Mortgage Amount Capital 212500. The following table shows the equivalent pre-tax hourly income associated with various monthly salaries for a person who worked 8 hours a day for either 200 or 250 days for a total of 1600 to 2000 hours per year. Take the amount of your mortgage payment and divide it by 12.

Estimate Your Monthly Mortgage Payments. 1 the property for which the tax is owed is subject to a mortgage that does not require the owner of the property to fund an escrow account for the payment of the taxes on the property. Monthly Payment Change any combination of fields to calculate.

Other costs and fees related to your mortgage may increase this. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Employees who work 5 days a week thus tend to work about 250 day less any other holidays time off. 3 If the residential real property securing a mortgage loan is not located in a State the loan is not a federally related mortgage loan. This calculator can also estimate how early a person who has some extra money at the.

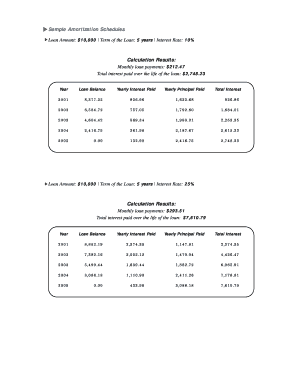

Multiply the factor shown by the number of thousands in your mortgage amount and the result is your monthly principal and interest payment. Using The Mortgage Payment Table. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

Which can be used to pay off the mortgage. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

The Payment Calculator can help sort out the fine details of such considerations. Initial interest Rate APR 2. Total of 360 Mortgage Payments.

Use our mortgage affordability qualification calculator to estimate how much you can qualify for based on your current income.

33 Contract Templates Word Docs Pages Free Premium Templates

Customize 33 Real Estate Newsletter Templates Online Canva Canva Selling House Real Estate Newsletter Templates

Anchor Now Lets Podcasters Monetize By Requesting Donations Of Up To 10 Per Month Let It Be Anchor Homes Technology Updates

12 Useful Charts To Help You With Your Move Moving Tips Moving Hacks Packing Packing To Move

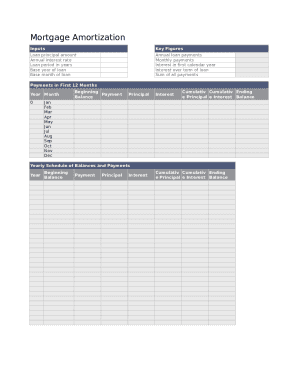

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Quarterly Performance Reviews Template Lovely Samples Of Performance Management Materials Fo Performance Reviews Employee Performance Review Statement Template

Well It S A Day That Ends In Y And Right Now That Means There S More Trouble For Wells Fargo In The Last Few Weeks The Wells Fargo Fargo Consumer Lending

33 Fact Sheet Samples Free Premium Templates

Soap Dispenser Automatic Soap Dispenser Equipped With Adjustable Switches Infrared Motion Sensor Waterproof Base Touchless Hands Free Soap Dispenser For Bat In 2022 Automatic Soap Dispenser Soap Dispenser Dispenser

Business Credit Card Authorization Form Credit Card Templates Business Credit Cards

33 Free Finance Printables

Composite Deck W Skirting And Black Railing Patio Deck Designs Decks Backyard House Deck

20 Stunning Covered Deck Ideas You Ll Fall In Love With Covered Patio Design Rustic Farmhouse Style Rustic House

Pin On Home Insurance

33 Free Finance Printables

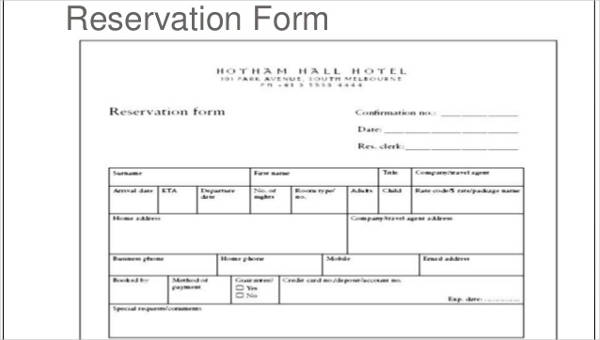

Free 33 Reservation Forms In Pdf Excel Ms Word

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller